1. GDP measures National Output.

GDP measures National output using official statistics. However, there are many discrepancies. Suppose you spend £1,000 a year on vegetables. But, then decide to convert your back garden into an allotment growing everything from seed. Your expenditure falls by £1,000 so National Output appears to fall, but you are still consuming the same amount of vegetables. A women may earn £10,000 a year working as a cleaner. When she gets married she continues to do the housework and cleaning, but, she doesn't get paid anything (maybe a little outdated example)

2. GDP per Capita.

Suppose:

- US GDP per capita is $20,000

- GDP per capita in Tanzania is $500

- Therefore, are living standards 40 times better in the US than Tanzania?

Another issue, is that maybe Tanzania underestimate their GDP because many people are subsistent farmers. i.e. they grow their own food and so do not declare an income. This lifestyle is rare in the US.

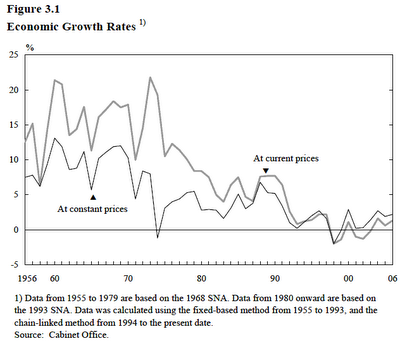

Economic Growth Rate in Japan

What Happens to GDP between 1973 and 1985?

- Many students will say, GDP is falling. However, this is wrong, GDP is not falling just increasing at a slower rate.

- I usually test my students with a question like this. On average 85% will get it wrong on the first time. 70 % will get it wrong the second time. Some students can take 9-10 attempts before they will remember the difference between an absolute fall and a fall in the rate of increase.

4. Household incomes have fallen.

Suppose we have a household with a man and a wife earning $26,000 a year. Their combined income for the household is $52,000. If they got divorced there would be 2 households with $26,000 it would appear there is a doubling of households who earn less than $30,000

Source: http://www.economicshelp.org/2008/05/misleading-economics-statistics.html

You could consider buying this

Now some interesting reading - read this

then look at the following (from here)

Pay particular attention to the graphs.

They look similar to these two, which I reconstructed by reading data off the charts on the BBC site. The first shows the cosmic radiation rate in neutrons per hour. The second is the temperature change since 1975 when it started.

Big scary temperature change, isn’t it.

Now look at the two graphs below. They show THE SAME DATA. From the same columns of the same Excel Spreadhseet.

Virtually constant solar radiation. Virtually constant temperature. You can’t extrapolate anything from this data. Doubly so when the solar radiation is known to be an EIGHTY year cucle, and you only have 25 years of data. All we’re seeing is the last peak of the graph!

And that, ladies and gentlemen is how to lie with statistics.

There are two morals to this story. The first one is don’t believe any charts you look at unless you understand what the data really means and how it’s being presented. And the second is to get some real data before trying to influence political decisions that will cost millions of people thousands of pounds and dollars!

Hidden in a dark corner of each major auto insurance company is a statistician or two whose job is to make calculations about the drivers who insure with the company. One way to make profits for the company is to employ statistics in a less-than-thorough manner. This article gives an example of how statistics can mislead.

Suppose we lived in a world where all drivers were equally capable of driving and equally capable of avoiding accidents and tickets. Let's simply suppose that some drive further each month than others, for commuting, shopping, visiting relatives, or whatever. Suppose there were a few who drive as little as 3,000 miles a year, and some, like professional drivers, who drive up to 50,000 miles a year.

Suppose that a zealous insurance CEO asks his statistician if drivers with two or more tickets in a three-year period were more likely to have an accident.[1] He would soon report back that drivers with two or more tickets have almost twice [2] the chance of having an accident.

Wow! Twice the accident rate! What fools! The CEO might think that by hitting these guys with higher premiums, he might make them think about their careless driving habits. Maybe it will teach them a lesson. The company can make quite a bit more profit, as other insurers are not going to try and steal the worst drivers away. Furthermore, the state motor vehicle departments start thinking about taking away these driver's licenses. Everybody thinks that these guys have to be gotten off the road before they kill themselves or someone else. Unfortunately, they aren't careless drivers. According to the assumptions, they are equally good at driving as everybody else. The statistics lied. The difference in mileage exposure alone is enough to produce a strong correlation between tickets and accidents.

You are probably thinking that even a closeted statistician can figure out that mileage alone is the key to the connection between tickets and accidents. All he would have to do would be to look at the mileage figures that the premium payers put down and see if that explains it. Regrettably, when Customer Joe looks at that blank space for mileage on the insurance application, he likely realizes that if he is a high-mileage driver and he puts his real mileage down, the company is going to bill him more. So he shades his mileage, perhaps putting 15,000 miles where 30,000 should be. Eighty-year-old Priscilla, who hardly ever drives, doesn't want to put down 2,000 miles as she is afraid the company will think she doesn't have enough practice to keep driving safely, so she puts down 6,000. Nobody checks Joe s or Priscilla s odometers. Furthermore, most companies don't update their mileage figures annually so that someone whose driving pattern changes might not be noticed by the company at all. Simply stated, the mathematician has no chance of figuring out the mileage connection he doesn't have good data. So when he tells the CEO that he has checked out this possibility, and as far as he can tell, the connection is not all due to mileage, he's right according to his numbers, but wrong according to the world.

This is probably the simplest statistics foolery that makes tickets look like they mean something that they don't. Regrettably, both the motor vehicle departments and the insurance commissioners of the states haven't quite realized that they are dealing with a complicated situation and bad data.

1. Don't forget, all drivers are equally good, but some have more exposure to accidents and tickets because they drive more.

2. Depending on the distribution of high mileage and low mileage drivers, the actual ratio ranges from about 1.6 to 1.9 for this simple example.

Now read these four articles

Article One

Article Two

Article Three

Article Four

And finally, read this:

The great Labour inflation lie

The problem is that sometimes these little government porkies are repeated so often that they turn into big fat dangerous old porkers. Those in power who told the original lie become so self-deluded that they start to believe it themselves. At the same time we become so used to being lied to that we refuse to believe or even hear anything they say. Eventually everybody becomes so confused that they forget how the whole argument started in the first place; they just despair at the havoc it has wreaked. And that, I want to suggest, is what has happened with the government’s inflation statistics.

It goes all the way back to the honeymoon days of May 1997, just after New Labour and the British public tied the knot. As Gordon Brown never tires of telling us, one of that government’s first acts was to grant independence to the Bank of England. In doing so he committed the Bank to targeting an inflation rate of 2.5% in the medium term; never again, he promised, would Britain suffer from the rampant inflation seen in the 70s and 80s and even in the early 90s. Inflation, he reminded us, was a political, social and economic menace that could be tolerated no longer. And many of us agreed with him.

Except that controversially (and perhaps rather cynically) he opted for a measure of inflation - initially the retail price index excluding mortgages (RPIX) - that excluded mortgage interest payments. In 2003 he shifted the bank's target rate again - even more cynically this time - to 2% consumer price inflation (CPI), a measure which is naturally lower even than the RPIX (due to the so-called 'formula effect'). And surprise, surprise, the CPI implicitly excludes virtually all housing costs - no awkward X needs to added. But for millions of UK households, of course, housing costs are and always have been their single biggest monthly outlay.

For a few years it didn’t matter. The economy was booming and inflation seemed under control, thanks mainly to ever-cheaper imports from developing economies. The real problems started when houses prices started to rocket. Things got even worse after 2003 - incidentally around the same time the government moved to targeting CPI. For many people - young people looking to buy their first house, for example, or families looking for some more space - normal homes were becoming more and more expensive, sometimes prohibitively so.

And yet the official inflation figures didn’t reflect this and remained on target. In the hallowed halls of Westminster and Threadneedle Street policymakers could congratulate themselves on a job well done, never mind the reality. And, understandably perhaps, those who had amassed a small fortune for doing little else than owning a house were slow to complain.

In short, because of those misleading inflation numbers, interest rates were way too low for far too long. Far from being prudent, the government was reckless and operating against its own stated policy aims. It promised to fight inflation but in truth the cost of living for millions was spiralling out of control thanks to the cheap money it was flooding into the economy at an absurdly inappropriate rate. The banks, of course, were only too happy to pick up the slack and encourage people to get into absurd levels of debt. Soon this became the only way to afford a half-decent semi near a half-decent state school.

Last year reckless Labour (and the nation) finally ran out of luck. Import costs began and have continued to rocket, fuelling severe inflationary pressures - a trip to the supermarket or petrol station or a glance at your latest fuel bill is testament enough to this. Even the official inflation numbers - laughable though they are - have shown a slight increase.

Meanwhile the debt crutch previously offered by the banks to struggling consumers has been cruelly swiped away. Millions are now left nervously wondering how they are going to pay back the cash they often borrowed simply to meet the spiralling cost of living. And house prices have been allowed to explode to the extent where the only hope that most young people have of buying a home is through receiving major financial help from parents - if they have that luxury. True social mobility is becoming a thing of the past - take a walk into the wealthier suburbs of London to see a vision of the future for the lucky few.

The official inflation rate, meanwhile, has only once risen above the 3% level that requires a letter of explanation from the Bank to the chancellor. The current official rate is 2.5%. And in the most recent budget Alastair Darling boasted of the government’s success in combating inflation and committed to the 2% CPI target for the remaining duration of New Labour’s hold on power.

Source: http://www.citywire.co.uk/personal/-/personality-finance/other/content.aspx?ID=299367

No comments:

Post a Comment